Offshore Trusts for Business Owners: A Hidden Asset Protection Tool

Offshore Trusts for Business Owners: A Hidden Asset Protection Tool

Blog Article

Checking Out the Trick Features and Advantages of Using an Offshore Trust Fund for Wealth Management

When it comes to wide range monitoring, you may locate that an overseas depend on provides special advantages you hadn't thought about. These counts on can improve possession defense, supply tax obligation effectiveness, and maintain your privacy.

Comprehending Offshore Trusts: Interpretation and Function

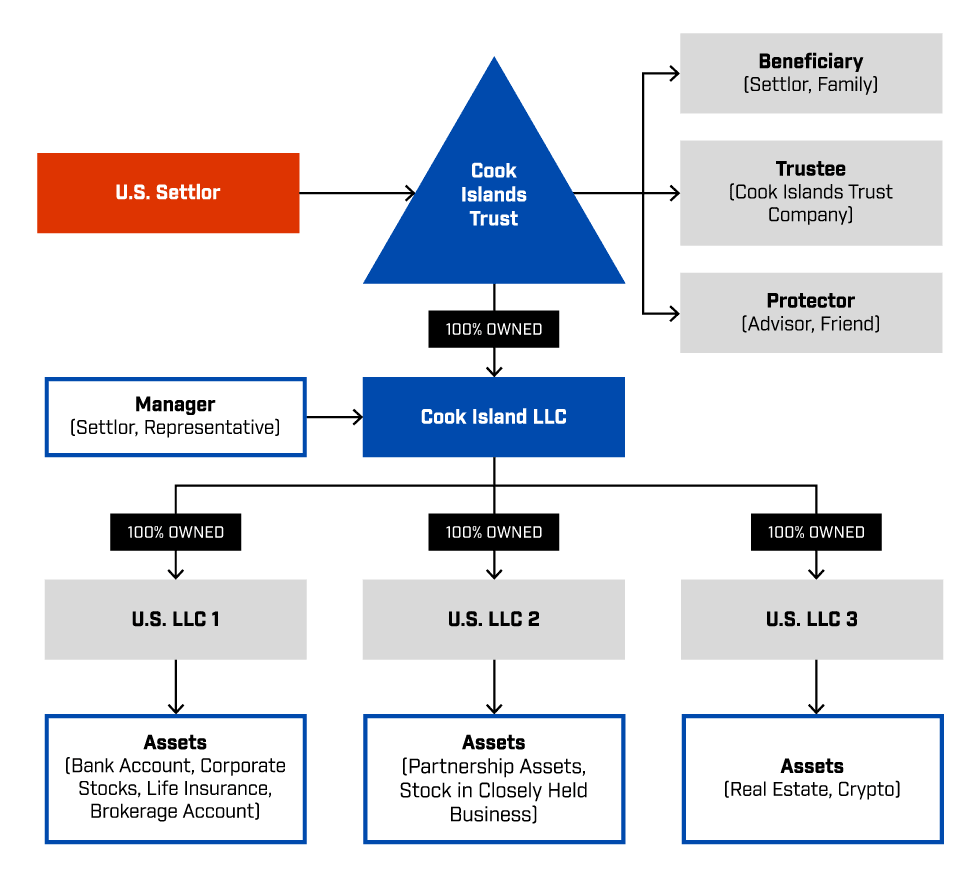

Offshore counts on function as powerful devices for wealth administration, supplying people with tactical alternatives for asset protection and tax obligation efficiency. These counts on are legal entities set up in jurisdictions outside your home nation, enabling you to safeguard your properties from creditors, claims, and also possible taxation. By positioning your wide range in an offshore count on, you obtain a layer of defense that might not be available domestically.

The main purpose of an overseas trust fund is to help you preserve control over your assets while guaranteeing they're managed according to your desires. You can mark recipients, specify exactly how and when they get circulations, and even set problems for asset access. In addition, offshore trust funds can enhance privacy considering that they typically secure your economic information from public scrutiny. Understanding these fundamentals can encourage you to make enlightened choices regarding your wealth monitoring method and explore the advantages of overseas trusts efficiently.

Key Features of Offshore Trust Funds

When considering overseas depends on, you'll discover two standout features: possession security methods and tax obligation performance advantages. These trust funds can shield your wealth from lawful claims while likewise maximizing your tax circumstance. Let's check out exactly how these vital functions can work to your benefit.

Asset Defense Techniques

One of the most compelling functions of overseas depends on is their ability to protect properties from possible legal insurance claims and lenders. When you develop an offshore trust fund, your possessions are held in a territory with solid privacy regulations and positive policies. This separation from your personal estate suggests that, oftentimes, financial institutions can't access those properties if you encounter legal obstacles. Furthermore, overseas depends on usually supply a layer of security versus political or economic instability in your home nation. By putting your wealth in a depend on, you're not only shielding your possessions but likewise making sure that they're managed according to your details dreams. This calculated method to property protection can provide you assurance and security for the future.

Tax Efficiency Benefits

Establishing an offshore count on not only uses strong asset protection but also presents considerable tax obligation performance advantages. By placing your possessions in an overseas trust fund, you can make the most of desirable tax regimes that many jurisdictions offer. These counts on can assist you defer taxes, possibly lowering your overall tax worry. In addition, revenue created within the depend on might not go through local tax obligations, offering you the chance to grow your wealth much more properly. You'll likewise have even more control over circulations, enabling you to handle when and just how your beneficiaries obtain funds, which can cause more tax advantages. Inevitably, an offshore trust can be a powerful device for optimizing your wide range administration technique.

Possession Defense Advantages

Because you're seeking to guard your riches, recognizing the asset defense benefits of an offshore trust is essential. An offshore depend on can secure your assets from lenders, legal actions, and unanticipated financial difficulties. Offshore Trusts. By positioning your wide range in this structure, you create a lawful barrier that makes it hard for others to assert your properties

Additionally, offshore counts on frequently run under jurisdictions with durable privacy regulations, meaning your economic details remains confidential. This privacy can prevent potential litigants or plaintiffs from pursuing your assets.

Tax Obligation Advantages of Offshore Trust Funds

While lots of financiers look for methods to reduce their tax responsibilities, offshore depends on can offer a tactical avenue for attaining tax obligation benefits. By putting your assets in look at these guys an overseas trust fund, you may benefit from reduced taxes relying on the territory's guidelines. Several overseas jurisdictions offer positive tax prices or perhaps tax exemptions, permitting your wealth to expand without the concern of too much taxes.

Additionally, offshore trust funds can help postpone taxes on funding gains till distributions are made, providing you more control over when you recognize those gains. You might also have the ability to protect certain possessions from taxes, depending on the trust fund framework and regional regulations. This adaptability can enhance your overall riches administration method.

Moreover, utilizing an overseas depend on can aid you navigate complex global tax policies, ensuring that you're compliant while enhancing your tax obligation placement. Simply put, offshore depends on can be a powerful tool in your riches management toolbox.

Privacy and Confidentiality Enhancements

When you established an overseas count on, you acquire enhanced monetary privacy that secures your possessions from unwanted examination. Legal confidentiality securities even more protect your info from prospective leaks and breaches. These features not only secure your wide range yet additionally give assurance as you browse your economic method.

Improved Economic Privacy

Improved economic personal privacy is among the vital advantages of developing an offshore trust fund, as it enables you to secure your possessions from spying eyes. he said By positioning your wealth in an offshore trust, you can significantly reduce the danger of unwanted examination from authorities or the general public. This structure maintains your economic affairs very discreet, making sure that your financial investments and holdings remain personal. In addition, overseas jurisdictions frequently have stringent privacy legislations that even more secure your information from disclosure. You obtain control over who has access to your monetary information, which assists secure you from prospective threats like claims or financial disagreements. Eventually, enhanced privacy not just safeguards your properties but also grants you comfort concerning your economic future.

Lawful Discretion Defenses

Offshore depends on not just offer boosted economic privacy but additionally use durable legal confidentiality protections that shield your possessions from outside examination. By putting your riches in an offshore count on, you benefit from strict privacy laws that numerous jurisdictions apply, making certain that your financial information stays private. This lawful framework secures you from unwanted queries and prospective dangers, permitting you to manage your assets with assurance. In addition, these depends on commonly restrict the information shown 3rd parties, improving your control over your monetary affairs. With overseas counts on, you can guard your wide range against lawful difficulties, lender claims, and various other dangers while taking pleasure in the privacy you should have in your wealth management technique.

Estate Planning and Wide Range Preservation

Estate preparation and wealth conservation are essential for safeguarding your economic future and ensuring your properties are secured for generations ahead. By developing an offshore trust, you can properly handle your estate, safeguarding your wealth from potential creditors and legal obstacles. This positive method permits you to dictate just how your possessions are distributed, guaranteeing your desires are honored.

Making use of an offshore trust fund also provides you with different tax benefits, which can assist optimize your wealth. You can decrease inheritance tax, enabling even more of your wide range to be handed down to your successors. Additionally, an offshore count on can safeguard your possessions from political or financial instability, more safeguarding your monetary heritage.

Incorporating an overseas trust right into your estate planning approach not just improves wealth preservation however likewise brings tranquility of mind, recognizing that your hard-earned properties will certainly be guarded for future generations.

Picking the Right Territory for Your Offshore Trust Fund

Exactly how do you select the ideal jurisdiction for your offshore count on? Consider the lawful structure. Try to find territories with solid property read the article defense regulations and regulatory stability. This assures your count on stays protected against prospective difficulties. Next off, analyze tax ramifications. Some territories provide favorable tax obligation treatment, which can enhance your wide range administration technique.

You need to likewise examine the track record of the jurisdiction. A well-regarded area can improve trustworthiness and decrease examination.

Frequently Asked Concerns

Can I Establish an Offshore Count On Without an Economic Advisor?

Yes, you can establish an overseas depend on without a monetary advisor, yet it's high-risk. You'll need to research lawful needs and tax obligation effects extensively to guarantee conformity and protect your properties properly.

Are Offshore Trusts Legal in All Countries?

Offshore trust funds are lawful in numerous countries, yet not all. You'll require to inspect the certain regulations in your country and the territory where you prepare to develop the depend on to ensure conformity.

How Much Does It Expense to Establish an Offshore Depend On?

Establishing an overseas trust fund typically sets you back in between $2,000 and $10,000, relying on aspects like jurisdiction and complexity. You'll also encounter recurring charges for management and compliance, so plan for those expenditures, as well.

Can Beneficiaries Access Funds in an Offshore Trust?

Yes, recipients can access funds in an overseas count on, but it commonly depends upon the certain terms and conditions established by the trust fund. You must evaluate those information to comprehend the gain access to policies plainly.

What Occurs if I Move Back to My Home Country?

If you relocate back to your home country, you'll require to consider local tax obligation implications and regulations regarding offshore counts on. It's essential to consult a lawful expert to browse these changes properly.

Report this page